Renting in America’s Largest Cities

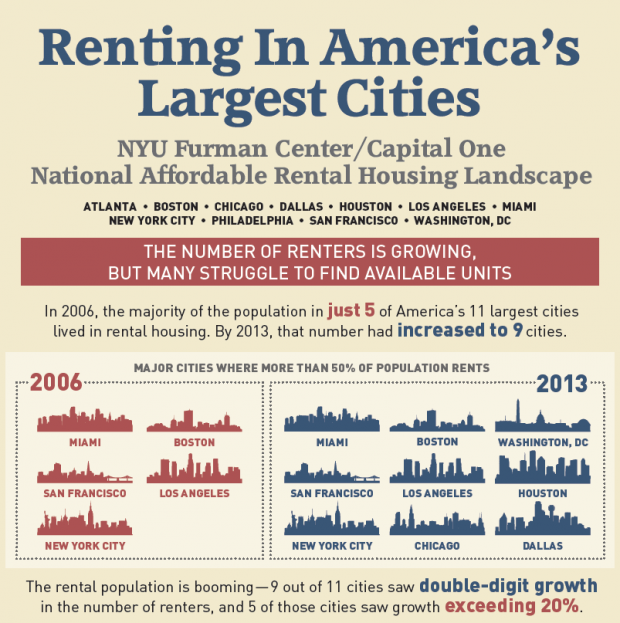

The supply of affordable rental housing failed to keep pace with demand in the 11 largest U.S. cities while rents rose faster than household incomes in five of the them. The NYU Furman Center/Capital One National Affordable Housing Landscape examines rental housing affordability trends in the central cities of the nation’s largest metropolitan areas (New York, Los Angeles, Chicago, Houston, Philadelphia, Dallas, San Francisco, Washington, D.C., Boston, Atlanta and Miami) from 2006 to 2013 and illustrates how these trends affected renters as more households chose to rent amid rising rental costs.

Nine of the 11 largest U.S. cities have seen falling vacancy rates and rising rents, which are hurting lower- and middle-income renters. “Affordable” rent should comprise less than 30 percent of a household’s income. With the exception of Dallas and Houston, the average renter in each metropolitan area could not afford the majority of recently available rental units in their city. The cities were even less affordable to low-income renters, who could afford no more than 11 percent of recently available units in the most affordable cities.

Since 2006, there has been an increase in the share of low- and moderate-income renters who are severely rent-burdened— meaning they face rent and utility costs equal to at least half of their income. In 2013, over a quarter of moderate-income renters were severely rent-burdened in seven of the cities in the study, while a significant majority of low-income renters in all 11 cities were severely rent-burdened. The percentage of low-income renters facing severe rent-burdens continued to rise in each of these cities and low-income renters are often most acutely impacted by the lack of affordable housing.

The study also found that in five cities, the proportion of moderate-income renters experiencing severe rent burdens grew remarkably, while in other cities, the situation for moderate-income renters either changed little or even improved.