Promotion of Healthy Eating through Public Policy: A Controlled Experiment

Background

To induce consumers to purchase healthier foods and beverages, some policymakers have suggested special taxes or labels on unhealthy products. The potential of such policies is unknown.

Purpose

In a controlled field experiment, researchers tested whether consumers were more likely to purchase healthy products under such policies.

Methods

From October to December 2011, researchers opened a store at a large hospital that sold a variety of healthier and less-healthy foods and beverages. Purchases (N=3680) were analyzed under five conditions: a baseline with no special labeling or taxation, a 30% tax, highlighting the phrase “less healthy” on the price tag, and combinations of taxation and labeling. Purchases were analyzed in January–July 2012, at the single-item and transaction levels.

Results

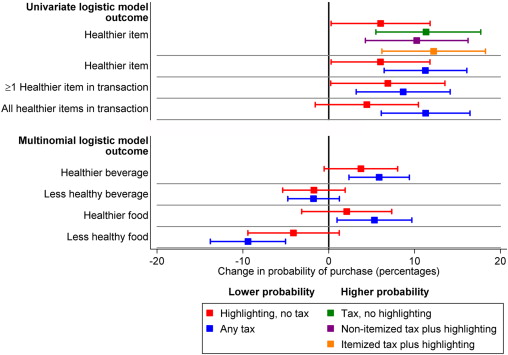

There was no significant difference between the various taxation conditions. Consumers were 11 percentage points more likely to purchase a healthier item under a 30% tax (95% CI=7%, 16%, p<0.001) and 6 percentage points more likely under labeling (95% CI=0%, 12%, p=0.04). By product type, consumers switched away from the purchase of less-healthy food under taxation (9 percentage point decrease, p<0.001) and into healthier beverages (6 percentage point increase, p=0.001); there were no effects for labeling. Conditions were associated with the purchase of 11–14 fewer calories (9%–11% in relative terms) and 2 fewer grams of sugar. Results remained significant controlling for all items purchased in a single transaction.

Conclusions

Taxation may induce consumers to purchase healthier foods and beverages. However, it is unclear whether the 15%–20% tax rates proposed in public policy discussions would be more effective than labeling products as less healthy.